CONTENT:

- Intro

- Why invest

- Investment opportunities and mindset to have

- Stock - Slice of a business rather than a random number generator

- Why Index funds are recommended and buying your own stock is hard

- Picking businesses for those who are willing to read (10000 hours?)

- Outro

(If this blog feels too long, using Microsoft Edge’s read aloud feature might help.)

Intro

I began learning about the stock market a year ago (so take this blog as a place to jump start your knowledge, but not as prescription of what you should do with your money). Objective/summary is to explain

- Index funds are best, except for those read a lot and are good controlling their emotions.

- If you already know this, feel free to skip this blog, unless you are curious about what else i have written about.

- Every investment comes with risk - know what you are doing to avoid costly mistakes and save your money from ignorance.

- Pros & cons, principles, pitfalls to avoid if you decided to buy (quality ) business, rather than taking index fund route.

- I also gave links to books & articles to interest you further .

Why invest

Inflation (capital preservation)

Inflation is the increase in prices for goods and services over time, which reduces the purchasing power of money.

For example, today’s $100 is not the same as $100 in 2014; it buys less now than it did ten years ago.

To preserve your current money, you need to invest it and aim for returns at least equal to the inflation rate. If your money sits idle, you lose purchasing power as prices rise regardless of what you do.

Capital appreciation

For those seeking financial independence, investing your existing capital at consistent long-term returns helps you reach your goals faster.

Investment opportunities and mindset to have

There are numerous ways to invest your money. While I’ll focus on the stock market, here are some other options I’m aware of:

- Fixed income options:

- Bank deposits (know if your deposit is insured, if not make sure bank won’t go bankrupt), Money Market Funds (MMF) or Bonds

- Be aware whether return is going to be greater or lesser than inflation.

- Stock market

- Real estate

- Commodities like gold

- Bitcoin (?)

Every investment carries some risk of losing money. Preserving your capital should be foremost priority. Growing your money can be the second.

Have a long term mindset, Don’t rush to earn quick money. Usually, that fear of missing out (FOMO) rush will only make you lose money.

Remember once your money gets halved to 50% due to loss, then you need the investment to return 100% to just break even. So opt for consistent returns rather than high risk high reward investments.

Be diversified - Don’t put all your eggs in one basket. Diversification ensures that if one investment goes belly up, your life savings are still protected.

Good investment opportunity should also have less tax burdens when you eventually decide to sell your asset. Also, know the tax implications if you gift the asset to someone else (like your heir). Tax deferred investment helps you to compound faster Be aware of how much tax you’ll have to pay in the end. Familiarize yourself with tax-deferred accounts like IRAs and 401(k)s. Understand the withdrawal rules for them and learn if they would benefit you. Be as tax-efficient as possible. For example, in the US, municipal bond funds and municipal bond-based money market funds are exempt from state tax whereas bank interests are not state tax exempt

Don’t invest money that you might need within 1-3 years. Opt for low risk bonds/bank deposits

If you invest money that you might need in 1-3 years in high-risk assets, there’s a chance the value of those assets could decrease, forcing you to sell at a loss.

With everything being digital, be sure to have unique passwords for each of your financial insitution. Use 2FA. If it makes sense (for eg in brokerages) restrict the ease of taking out the money (example Fidelity’s security lockdown feature restricts taking out the money from brokerage )

Stock - Slice of a business rather than a random number generator

The stock market is where people buy and sell businesses, similar to how tomatoes are sold in a vegetable market. A seller quotes a price, and when a buyer agrees, they exchange cash, and the tomato is sold. Stocks are traded similarly via the stock exchange with help of brokerages, with prices fluctuating every microsecond.

Businesses are divided into smaller units called shares, which are traded because not everyone can afford to buy an entire business. Share prices are influenced by fear and greed, making them unpredictable in the short term. However, over the long term (5-10 years), stock prices tend to follow the business’s profits. One buys a share so that they can get the profit attributable to their share of the business.

Let me give an example using Microsoft(MSFT).

There are 7.43 billion shares of MSFT, currently trading at $416.79.

MSFT’s total net profit is $88.13 billion, so profit per share is $11.86.

As a shareholder, you can expect this $11.86 to be given back to you.( although in reality profits would be tried to be reinvested in business so that the shareholder would get bigger profit per share next year).

Earnings yield is (earnings per share/ share price) * 100% . Earnings yield is analogous to interest rate on a savings account, showing how much profit you earn for each dollar invested in a company’s stock.

The earnings yield of MSFT is $11.86 / $416.79 = 2.84%. So 2.84% of money you invested can be returned to you as part of profit attributable to you. However, with the US government / bank accounts offering a ~5.3% risk-free interest rate, why buy a share, it doesnt make sense right? Let me explain.

MSFT’s earning per share before 10 years was $2.67.

Look how profit per share went from $2.67 to $11.86 in 10 years

That’s the reason people are ready to buy MSFT share today. Its not today’s earnings yield they are looking for, instead the one they would be getting after 10 years. So overall MSFT owners believe by owning shares, they would get more money than what they would get with US gov interest rate.

This process of estimating future profit and discounting it to today’s value is called Discounted Cash Flow analysis (more on this later).

In summary: You own a share, so you can get part of company’s profit. Even if todays earnings yield is not good, as company grows, you expect higher earning yield for you in future. So important thing to note is, its not enough for a company to be profitable, but it should keep growing its profit, i.e profit should become bigger and bigger.

Why Index funds are recommended and buying your own stock is hard

For you to make profits, a company should be increasing its profit for the foreseeable future. This means management must be shrewd, the company shouldnot be disrupted by newer technologies, the field should be growing or the company’s market share within field should be growing etc etc.

How can you be sure a business will grow its profit in the future? You need to understand the business’s sector, its customers, competitors, and the management team. You need to read Company’s annual report, quarterly report, earnings call and much more. And to some extent you need to read about the competitors and customers.

Even after thorough research, what if you make a mistake in your analysis? What if the company loses money, its profit decreases, or remains flat? In these scenarios, you’re likely to lose money.

Therefore, buying a single business is not recommended. You shouldn’t put all your eggs in one basket. Depending on who you ask, you might be advised to diversify by buying at least 12 to 50 companies.

It’s not impossible to research and buy more than 12 companies, but it’s very challenging. Is it worth your time?

So instead of you, having to study about businesses and pick individual business. Buying index funds are recommended

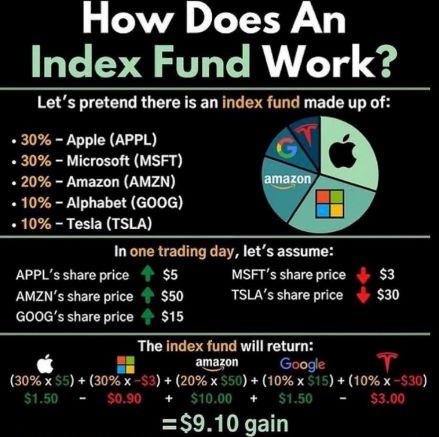

An index fund is an easy way to invest in every stock of an index (like S&P 500 or Nifty 50), generally in proportion of size of the company.

Index fund is a mutual fund or ETF that aims to mirror the performance of a specific index.

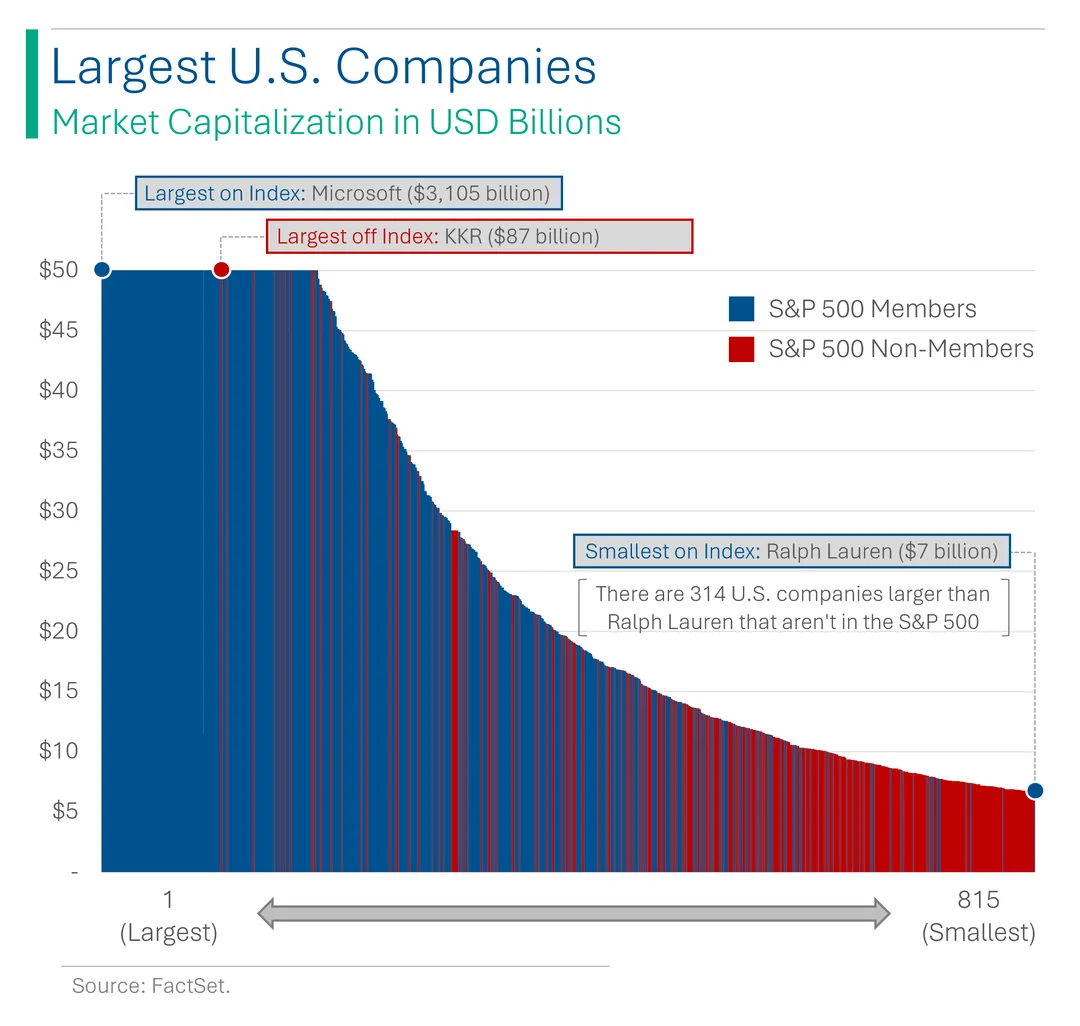

An index is basically a bunch of stocks selected based on certain rules (such as largest 500 companies in US). These indices are typically weighted by market capitalization.

S&P 500 index : Tracks 500 of the largest U.S. companies by market capitalization.

Nifty 50: Represents the top 50 companies listed on the National Stock Exchange (NSE).

Each quarter, based on changes in market capitalization, companies are added or removed from the index, and weightings within the index are adjusted.

Be sure to read about rules for inclusion and exclusion. For instance when I said S&P 500 tracks largest 500 US companies, it was not factually true but more or less true. once included in the S&P 500, it’s harder to be removed, only if they meet rules of exclusion, stocks can be removed from S&P 500. So even if a new company grows to become a top 500 business, one company which is already in S&P 500 need to exit to allow space for this new company. And this is fine because, this rule keeps turnover ratio low, hence keeping tax low. (PS: The image above is a few months old. The largest company off the index is no longer KKR, as KKR was recently added to the S&P 500.)

Be sure to read about rules for inclusion and exclusion. For instance when I said S&P 500 tracks largest 500 US companies, it was not factually true but more or less true. once included in the S&P 500, it’s harder to be removed, only if they meet rules of exclusion, stocks can be removed from S&P 500. So even if a new company grows to become a top 500 business, one company which is already in S&P 500 need to exit to allow space for this new company. And this is fine because, this rule keeps turnover ratio low, hence keeping tax low. (PS: The image above is a few months old. The largest company off the index is no longer KKR, as KKR was recently added to the S&P 500.)

However some index rules may seem illogical.. For example, the Dow Jones index includes 30 stocks weighted by stock price, which is meaningless because comparing share prices without considering share count is absurd. Companies can manipulate weightings through reverse splits. Here’s a blog for more explanation.

Similarly, Once you understand the Nasdaq-100 inclusion policy, you’ll see it’s not exactly a tech ETF as commonly believed. The Nasdaq-100 tracks the largest 100 stocks on the Nasdaq exchange. This results in excluding quality tech businesses such as Mastercard, Visa, because they are not listed in Nasdaq exchange. Additionally, it excludes financial and REIT stocks. Because the Nasdaq-100 excludes many stocks, it is generally not recommended over the S&P 500 or total market index funds.

The whole point of the S&P 500 is that since you won’t know which sector will flourish, you include stocks from all sectors and use market cap-based weighting.

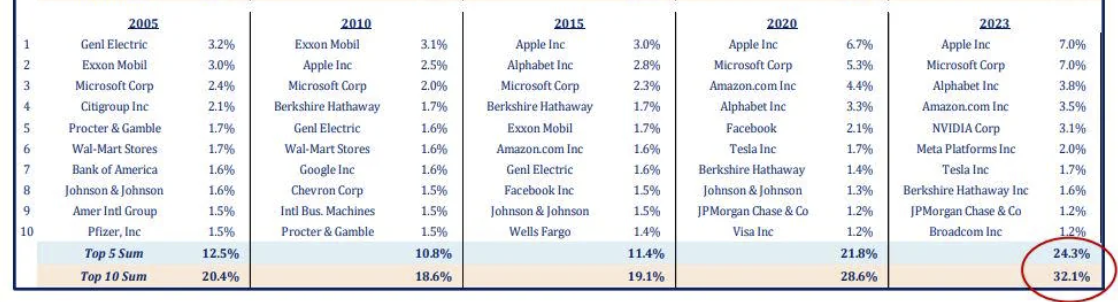

Over time, inclusion and exclusion automatically push out degrading companies and add new growing companies to the index. In the image above, If you look at top 10 weighted stocks of S&P 500 at 2010 and 2023, it would be clear. Look how Exonn mobil had the largest weightage during 2010 but its nowhere in top 10 of 2023. Nasdaq-100 will be less efficient in doing this than S&P 500.

Over time, inclusion and exclusion automatically push out degrading companies and add new growing companies to the index. In the image above, If you look at top 10 weighted stocks of S&P 500 at 2010 and 2023, it would be clear. Look how Exonn mobil had the largest weightage during 2010 but its nowhere in top 10 of 2023. Nasdaq-100 will be less efficient in doing this than S&P 500.

So always know the rules for inclusion of stock, exclusion of stock and weightage rule of an index

There are all sorts of index funds, like thematic ETFs (e.g., ETFs for tech stocks, ETFs for semiconductor stocks) and 2x or 3x leveraged ETFs. Avoid them. The former doesn’t provide enough diversification, and the latter uses leverage, so if the index falls 33% in a day, a 3x leveraged ETF goes to zero, and you lose all your hard-earned money.

Go for large indexes with diversified businesses. If you are in the US, S&P 500 or total market index funds are recommended. If you are in India, Nifty 50 index funds are recommended.

There would be different index funds tracking the same S&P 500 index. With all else equal, go for the lowest expense ratio. For example, SPY and VOO both track the S&P 500, but SPY has a 0.06% expense ratio, while VOO has a 0.03% expense ratio. So, going with VOO makes sense.

The expense ratio of an index fund is the annual fee that investors pay to cover the fund’s operating expenses. For instance, if an index fund has an expense ratio of 0.05%, you pay $5 annually for every $10,000 invested (doesn’t matter if you had profit or not)

Buying index funds is called passive investing, because index fund passively tries to replicate the index. Active funds (where a person picks stocks for the fund rather than following fixed rules like an index) are statistically not recommended (at least in US, not sure about statistics of other nations).

Due to high fees and less tax efficiency, most active funds lose to passive index fund returns over the long term. As you can see in the image taken from source. 86% of active underperformed their benchmark indexes. How would you know which active fund can beat index fund over long term? Sticking with index fund is safer!

Due to high fees and less tax efficiency, most active funds lose to passive index fund returns over the long term. As you can see in the image taken from source. 86% of active underperformed their benchmark indexes. How would you know which active fund can beat index fund over long term? Sticking with index fund is safer!

If your investing strategy is anything other than index funds, in my opinion, you need to have well informed reasoning. The reason cannot be just wanting higher returns, as higher returns are associated with higher risk (of losing money).

Low-cost, well-diversified index funds have statistically given the highest possible return for the least effort and least risk.

In summary, In US markets buy a low cost S&P 500 (eg VOO) or US whole market (eg VTI) index. In India, buy low cost Nifty 50 index.

Read more to form an opinion whether international index fund and bond fund makes sense for you or not. There is no unanimous opinion on this

Some reads on when to invest:

- Even God Couldn’t Beat Dollar-Cost Averaging

- Investing in Stocks At All-Time Highs

- Lump-sum investing versus cost averaging: Which is better?

Resource for general study to help u more

- Bogleheads wiki and

- JL Colins Stock series blog or

- A Random Walk Down Wall Street-book

- The Bogleheads’ Guide to Investing I haven’t read this book, but have heard good reviews about it

Picking businesses for those who are willing to read (10000 hours?)

“It is not uncommon for three-quarters of the index’s return to be linked to only 50 to 75 stocks.” - Investopedia. So, if you could somehow use a magic crystal to buy only those 50 stocks, then you would get better returns than index funds. This allure is what often tempts many to pick individual stocks instead of investing in the index.

While it’s very hard to consistently pick great businesses, it’s not impossible. However, the effort and knowledge required are so significant that, in my opinion, if you choose this route, it should be your first priority in life.

Initially, I had decided not to write this section to avoid distracting someone from buying index funds. But if someone can go from From zero to Olympic gold in just 7 years , then who am I to decide what you can or cannot do with your money?

You don’t need to be a born genius to excel at stock picking; you just need to take one step in the right direction consistently. If you can compound in the right direction, then you are only going to get better.

Don’t wish you were Naruto or Sasuke. Be Guy Sensei. Naruto & Sasuke had power right from birth. However Guy sensei, started as zero, kept compounding his effort, to become most powerful shinobi 💪🏻 and got acknowledged by Madara.

Pros

- Someone buying great business which can grow its revenue in double digits for next 2 decades is a great feat. The skills attained during this process should be transferable to other parts of life.

- Personally, I get attracted to doing hard things; maybe you do too.

- “Investing isn’t just a process of wealth creation; it is a source of great happiness and sheer intellectual delight for the truly passionate investor.” - Gautam baid

- Picking a diverse set of quality businesses at a good price can consistently beat average market returns. In long term even 1% makes a difference

- $10000 compunded at 10% for 30 years results in $174,494.02. Whereas 11% compounding results in $228,922.97 (longer the time period, more pronounced difference)

Cons

- Statistics are not on your side.

- You are signing up to reading a lot and you could still underperform the market.

If you are picking a business then you have to read (atleast, per business) 4 quarterly reports, 4 earnings call, 1 annual report, all the interviews given by Company’s c suite. You also have to keep reading about the industry in which the business is in (ideally u want the industry to grow, and the business to grow even faster than industry, taking market share), while also tracking how the competitors are doing and also how the customers are doing.

Basic Terms introduction

Revenue : total amount of money a business makes from selling its products or services.

Gross profit : money a business makes after subtracting the cost of making and selling its products or services i.e revenue - cost of goods.

Operating Expense (Opex) : day-to-day costs of running a business. Think of it as the money you spend to keep the lights on and the business running smoothly

Capital Expense (Capex) : expenses that would result in revenue, over the next years. Eg - expense of buying a factory

Note: While Opex affects net profit directly, Capex does not. Capex goes into the balance sheet as an asset. Over time, it gets subtracted from the income statement as depreciation (for tangible assets) or amortization (for intangible assets).

Net Profit: Accounting profits (Company doesnt necessarily receive this amount as cash in hand).

Can be calculated as,

Net Profit = Revenue - (Cost of goods sold + Operating expense + Depreciation/Amortisation + Interest expense + Income tax)

Using accounting techniques, net profit can be legally manipulated to achieve a certain value. However, in the long term, any manipulation will revert back. Keep in mind that short-term net profit can be manipulated, so Free Cash Flow (FCF) is a good metric to watch for.

FCF (Free cash flow): This is the cash a business has left over after paying for its operating expenses and capital expenditures. Its the cash profit the company has in hands.

PE ratio:

Price per share / Earnings per share.

It’s like seeing how much investors are willing to pay for each dollar of earnings.

A high P/E might mean the stock is overvalued, or investors expect high growth.

P/FCF ratio : Similar to PE ratio, but with wrt FCF instead of net profit.

Earnings yield :as we have already seen The percentage of profit attributable to one share relative to the price of that share.

ROIC : profits/ invested capital. What percentage of invested capital is generated as profit. Indicates efficiecy of the company.

ROE : profits/equity. Be careful, it can be elevated by using higher leverage (liability).

Equity = Asset - Liability from Balance sheet.

Dilution :

Phenomenon where company issues more share. This is bad for shareholders. because they buy shares based on Earning per share (EPS). If profit stays the same but number of shares increases, then EPS reduces. It’s like adding more water to a soup, making each bowl less concentrated.

Dilution happens when business pays their employees with stock. They can also issue stock during acquisition or with convertible notes .

Dilution as such is not bad, if profits can out grow the share increase.

Since share count keeps changing, always look at EPS or FCF/share rather than whole Net profit or FCF.

Buyback :

Company buys back its own shares from the market. Essentially opposite of dilution. reducing share count, so EPS increases. hence value of share now increases.

This is one way of returning money to shareholders. More tax efficient than dividend.

Dividend:

Company’s earnings distributed to shareholders, usually in cash. This is another way of returning money to shareholders. You have to pay tax for dividend.

Is dividend good? Dont buy a stock just for dividend, money is returned to shareholder means, there is no other good way to reinvest, so that means profit wont be growing much over long term.

Overall profit you may get by holding a share maybe attributable to

- Earnings growth (which can be via organic growth or via M&A)

- Valuation ratio growth (think PE ratio or P/FCF ratio),

- Dividend ,

- Buyback.

Most metrics can be legally manipulated if desired. so never rely on a single metric

Just like how two eyes are needed for depth perception, use multiple metrics to gain a clearer understanding of a company’s true profitability and growth.

What Constitutes a Quality Business?

A quality business is one that you never have to sell and keeps compounding. Some good books on this topic are “100 Baggers,” “Quality Investing,” and “The Little Book That Still Beats the Market.” (links given below)

Key Characteristics:

- High Return on Investment: A business with a return on investment (ROIC or ROCE) (above 15%?)

- Reinvestment: A business that can keep reinvesting in itself at a high rate.

- Good Management:

- Execution: Ability to executes what they had promised earlier (its not always easy to do as you promise)

- Capital Allocation: Finding the best use of capital via organic growth, mergers and acquisitions (M&A), buybacks, or dividends to maximize value for shareholders.

- Integrity: Being honest and not overpromising.

- Shareholder-Centric: Ensuring shareholders benefit, focusing on growth, and giving back to shareholders.

- Competitive Advantage (Moat):

- A business should not be easily disrupted by newcomers and should have a competitive advantage (moat). Even after 10 years, the business should be growing profitably.

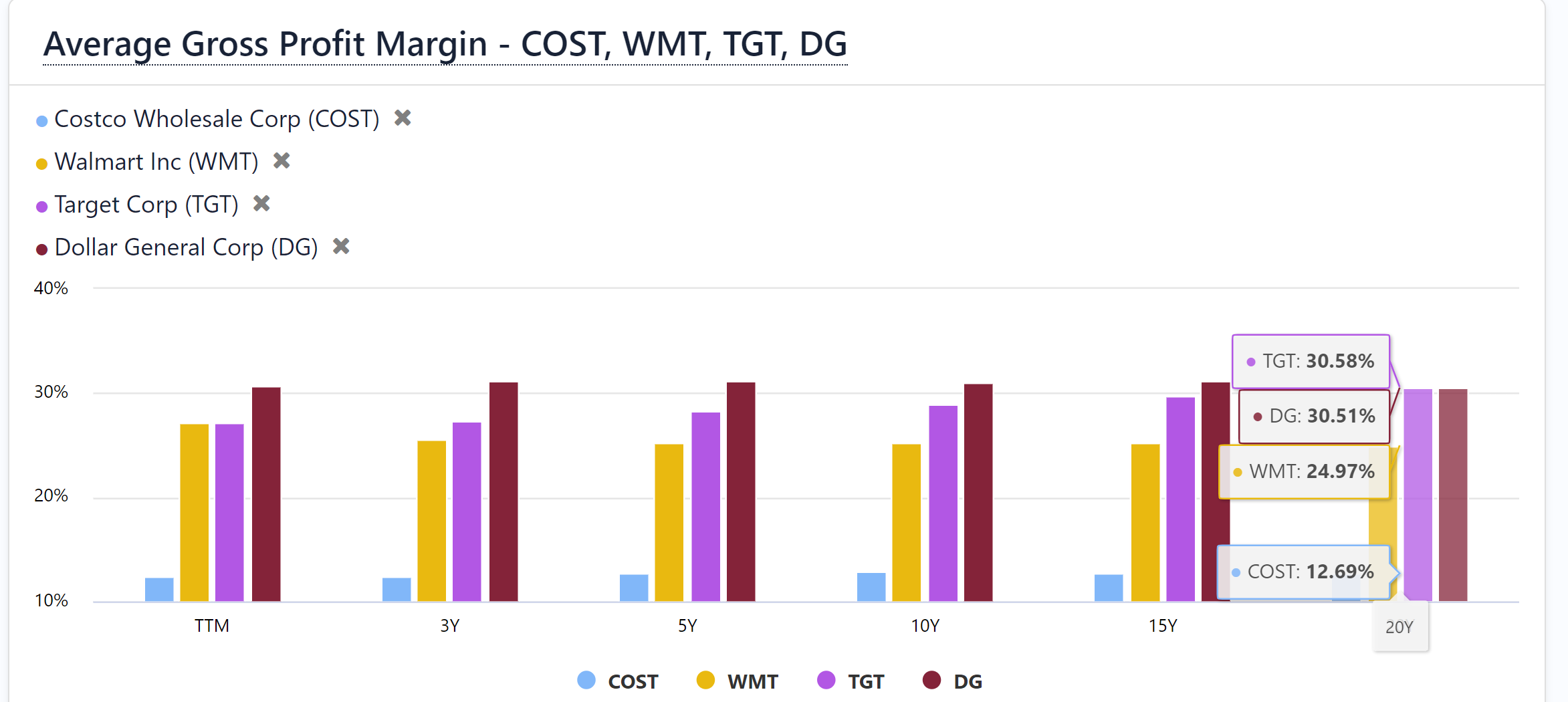

- Generally, a higher profit margin compared to competitors indicates pricing power (a competitive advantage). However, this is not the only indicator. For example, Costco has low margins but passes the savings to customers, which itself is a moat, because customers will keep returning to Costco.

- Again, no single metric cannot be relied upon

- Again, no single metric cannot be relied upon

- Important thing to keep in mind is moat either keeps growing or reducing over time. it doesn’t stay the same

Note: The business you buy need not be complex or a tech company. Any company that can keep growing its profit and has a reasonable initial pricing ratio can provide good returns.

“This is not like Olympic diving where they have a ‘degree of difficulty’ factor. You get paid just as well for the most simple dive, as long as you execute it all right. And there’s no reason to try those three-and-a-halfs when you get paid just as well for just diving off the side of the pool and going in cleanly.” - Warren Buffett

Examples: Monster, Domino’s Pizza are simple businesses which gave great returns

How I would start reading about a business

I would listen to 2-3 earnings call to infer what are the terms being used. Then try to understand quarterly report (10Q). After that read annual report. Initial days of reading a business, I would have absolutely no clue what is being talked, but over time, dots get connected and I will understand decent amount of details (only to find that this business is not that great😪 )

Valuation and when to buy a stock:

Simple valuation ratios: Obviously best time to buy something is when its cheaper. You can simply compare current valuation ratios (such as PE, P/FCF, EV/EBITDA, PS) to past values or to its comeptitors to come to an conclusion about its valuation. But it doesnt exactly tell if stock is actually undervalued, it only tells relative valuation compared to its past or present competitors

Discounted Cash Flow (DCF): This involves estimating the Free Cash Flow (FCF) per share of a business over the long term, potentially until eternity. You sum up these future cash flows and discount them to today’s value to get a fair value of a share. However, the result can vary significantly based on your estimates of FCF growth and the discount rate you use. estimating FCF growth is quite complex and may be unrealistic for a beginner to attempt. The DCF Model Explained - YT

Reverse DCF: More meaningful, especially in the early years of your investing journey. Instead of determining the fair value of a share, you start with the current share price and work backward to determine what FCF growth is implied by that price. From there, you decide whether that FCF growth is realistic or not. This approach is more practical for beginners, in my opinion. Reverse DCF explained - YT

Efficient market theory suggests that all available information is already reflected in stock prices. Meaning stock can never be over or undervalued. In a way, Narrative or stock growth determines price. While a news which can be pain to business over short term, but over long term (based on your knowledge on business, management etc.) you may consider the news to be not that negative. Hence the stock maybe efficiently priced as per the news (but in your perspective the news is not that negative), so in your perspective the stock looks undervalued.

You want great businesses that are having temporary problems.

In my opinion, risk of owning individual stocks, can be reduced to certain extent if u diversify enough and if u know hell lot about the company

Good mindset to have

- Remember, it’s very easy to lose money when buying your own stock. Buying stocks is not a get-rich-quick affair! Safety first; don’t try to race to your first million.

- Picking stocks is about rejecting businesses. You are looking to say no, not yes.

- Minimize the chance of losing money. Always read and ensure there’s a very low chance of losing money. Look for an unfair advantage where you can win big and lose less money. If you take care of the downside, the upside will automatically be taken care of.

- Confidence in your thesis. Before buying, ask yourself if you would bet on your thesis being correct. If you’re not sure, why aren’t you buying an index fund?

- Don’t buy in doubt. It might be hard to discard the work you’ve done, but when in doubt, don’t buy.

- Read extensively. Read every piece of publicly available information about a company. The more you know, the better you can estimate its growth. Reading more reduces your risk.

- Avoid borrowed conviction. Don’t follow social media blindly. What would you do if the stock they recommended (and you bought) falls 50% and the person stops posting about it? Do you know if you should sell, buy more, or what to do on your own?

- Avoid buying with borrowed money. Very risky

- Accept missed opportunities. Sometimes you miss the boat. Accept it, think “good for those who bought,” and move on. Hindsight bias is real. Don’t FOMO

- There is no, no-brainer investments. Picking a “too big to fail” company is not the answer. Profit growth is all that matters. For example, Intel has been too big/important to fail since the 2000s, but their profit hasn’t grown much, hence their stock price hasn’t grown much. If profit remains stagnant or even if growth reduces a bit, people might panic sell, reducing the multiple. A great example is PayPal stock.

- In every transaction other person has an opposite view. For every share you buy, someone is selling. Control fear and greed, and use an objective mindset.

- If a stock is down 50%, it doesn’t necessarily mean it’s a good buy. The stock might have been overvalued before, earnings could have dropped, or future income might be expected to grow less or even shrink. Conversely, if a stock went up 50% in one year, it doesn’t automatically mean it’s overvalued. You need to consider future growth expectations and past valuations.

- more points hidden under this toggle

- Absolutely don’t buy pre-revenue companies, biomedical, airline, or even sports apparel companies. Don’t fall for the “next big thing” businesses.

- Don’t do intraday trading. Stay away from using leverage (F&O - call, put, long, short). Leverage is the easiest way to lose all your money faster.

- Don’t follow stock prices; follow the net income of the stock, or better yet, follow free cash flow (FCF). Market reactions after earnings don’t always mean the earnings were bad. Read the quarterly report and form your own opinion. Yes, the market can be wrong in the short term.

- Form your own checklist to help your thought process.

- Don’t just trust CEO’s guidance. While they can be genuine, a CEO’s job is to market their company as the best in the world. You have to read between the lines to understand what’s happening. Don’t fully assume analysts’ price targets are correct; that’s often misleading. The same goes for anyone in the news predicting doom. They can’t say for sure either.

- Doubt everything, but trust management enough to give them some space. Focus on long-term growth rather than short-term fluctuations.

- Keep learning, keep improving, and keep your emotions in check. Tune out the noise. Read about biases and behavioral investing flaws. Fear, greed, and capital gains taxes will always challenge you. Be wary of them. Stay calm, not greedy or fearful.

- Past performance doesn’t indicate future performance, but it generally forms an upper limit. If a business has been compounding at 6% a year, for it to become 10%, it needs a strong reason.

- You can never catch the bottom or peak. Always dollar-cost average (DCA).

- Read what the CEO’s salary is and what metrics are targeted for their performance stock units.

Books (if i were to read all these again, I would read them in this order)

- What I Learned About Investing from Darwin by Pulak Prasad

- Richer, Wiser, Happie

- The Little Book of Behavioral Investing

- 100 Baggers just to help you get long term view (instead of looking for 100x, look for 10 bagger)

- Warren Buffett Accounting Book: Reading Financial Statements for Value Investing

- Accounting 101 (taught by a non-accountant) - YouTube

- All Peter lynch books (most popular - One Up On Wall Street)

- The Joys of Compounding

- Common Stocks and Uncommon Profits and Other Writings

- The Intelligent Quality Investor

- The Essays of Warren Buffett: Lessons for Corporate America - get the latest edition (link redirects to amazon.com)

- The Warren Buffett Way (nice book on Buffet’s early investment stage life, also had a good chapter on behavioural biases on investing)

Books I haven’t read but could be valuable addition to above list

Reading all these stuffs takes time.. be patient, don’t get overwhelmed

Outro

Whatever your investment decision is, make an informed one. Know why you’re buying this asset (eg stock) rather than another (eg real estate, gold). Keep learning and regularly check if your thesis is still intact. Don’t be in denial if you are wrong.

You will always hear success stories of someone earning 1000x their money in options, Bitcoin, or Nvidia. Remember, only those who made money show off. The 99% who made similar bets and lost don’t share their stories. You only hear from the winners. Please don’t YOLO your money like this person in blind. Someone fomo’d into NVDA after it’s massive rally and are now at a big loss. They said “so I’m gonna lose 80% of my savings over the weekend. What are some ways to come back from this reset in my life? I can think of taking on an extra part time, and have at it for 20+ years” This is why diversification, long term mindset etc are important.

Everyone makes mistakes in their investment journey; but make sure they won’t hurt you for the rest of your life. Be responsible with your money.

Learnt Something new?

Show some ❤ by sharing this with someone who might need this.

Any sort of feedback or replies are encouraged. Comment below or mail me at saisblog@proton.me